Are you still surprised that the number of people with bad credit is growing day by day? I think I m rather immured to it already! Bad credit is not the end of the world and it is up to us to find ways to repair it and get back on our feet, financially.

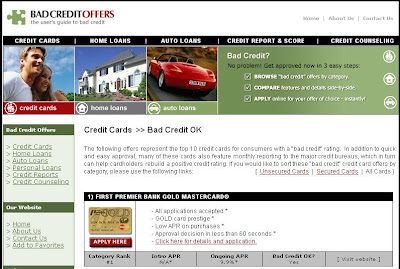

There are many bad credit offers that come our way but smart ones would check them out and compare them with other bad credit loans first because committing to an offer. If you are in the look out for bad credit loans, whether it is home, personal, auto or credit card loan, you may want to check out the website of Bad Credit Offers.

Remember, credit repair is not out of reach even if we have bad credit right now. If you do not default on your repayment of bad credit loans, you can rebuild your credit score!